Jacksonville-based Urban SDK has closed a $65 million growth round led by Riverwood Capital, marking one of the largest single investments in a geospatial AI company focused exclusively on local and state government operations. The platform helps municipalities turn real-time traffic, safety, and infrastructure data into actionable decisions for resource-constrained public agencies. The Florida Opportunity Fund, a state-created venture program that has backed the company since its earlier seed stages, also participated in the round.

The capital injection represents a dramatic leap for the firm, which had previously raised approximately $8.7 million across multiple seed rounds since its founding in 2018. JEGI LEONIS, an M&A advisory firm specializing in technology and media transactions, served as Urban SDK’s exclusive financial advisor on the deal.

From Seed-Stage Startup to GovTech Growth Contender

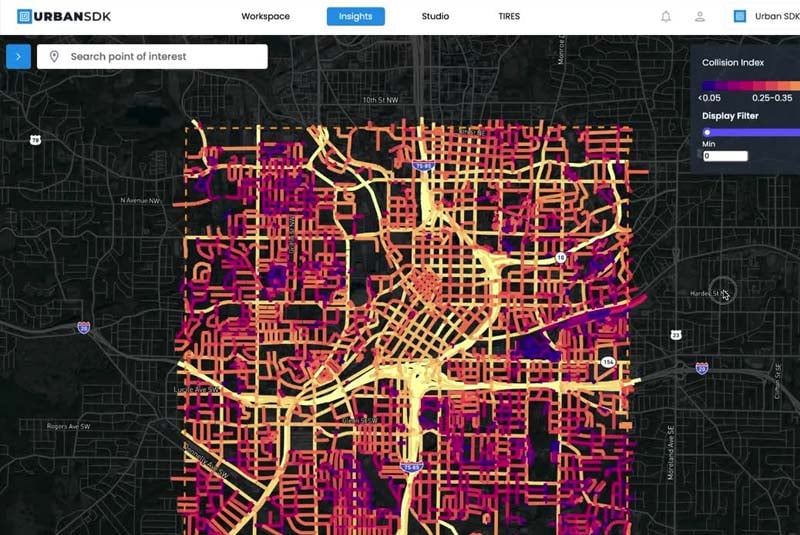

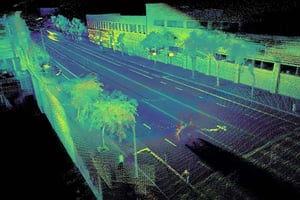

Co-founded by CEO Drew Messer and COO Justin Dennis, Urban SDK began as a traffic data analytics platform and has since evolved into what the company describes as a geospatial AI “system of action” for municipal and state agencies. The platform consolidates real-time location data, traffic patterns, crash records, and citizen complaint information into a single operational environment designed for public works officials, transportation planners, and law enforcement.

The company’s earlier funding came through a series of seed rounds supported by DeepWork Capital, GOVO Venture Partners, the Florida Opportunity Fund, Techstars, and VenVelo. Annual recurring revenue grew by 145% in 2022, according to a prior company announcement, and Urban SDK reported approximately $3.2 million in revenue by late 2025 with a 29-person team.

What the Platform Does and Who Uses It

Urban SDK’s geospatial AI tools serve more than 300 local government customers across 40 U.S. states, spanning cities, counties, and state Departments of Transportation. The platform addresses a broad set of municipal use cases including traffic speed monitoring, collision risk scoring, route analysis, and emergency response coordination during natural disasters.

The company claims its technology enables governments to achieve comparable operational outcomes at roughly one-tenth the cost of conventional approaches. With municipalities across the United States allocating an estimated 70% of their general fund budgets to public safety and community services, the pitch centers on helping stretched agencies do more with less through data-driven automation.

Riverwood Capital Brings Growth Infrastructure and Board Representation

Riverwood Capital, the lead investor, is a private equity firm managing approximately $6.1 billion in assets that targets growth-stage technology companies. Founded in 2008, the firm has backed over 90 portfolio companies with typical investment sizes ranging from $25 million to over $250 million. Riverwood operates from offices in Menlo Park, Miami, New York, and São Paulo.

As part of the transaction, Riverwood’s Eric Ma will join Urban SDK’s board of directors. The firm’s co-founder and managing partner, Francisco Alvarez-Demalde, has pointed to the platform’s ease of deployment and rapid adoption among frontline municipal workers as key factors behind the investment decision.

Timing Aligns With a Maturing GovTech Investment Cycle

The round arrives at an inflection point for the government technology sector. According to industry data, GovTech deal volume in Q1 2025 reached $3.1 billion, the strongest first quarter in recent years. The broader global GovTech market is estimated at approximately $858 billion in 2026 and is projected to grow at a compound annual rate of nearly 15% through 2035.

A recent analysis of early-stage GovTech startups found that the share advancing from seed funding to Series A rose from 18% during 2016–2020 to 23% in 2021–2025, a roughly 30% improvement. Analysts attribute the shift to mounting fiscal pressures on municipalities, AI-driven efficiency gains, and a new generation of founders who understand how to navigate public-sector procurement cycles.

The 2026 GovTech 100 list, published by Government Technology, highlighted $11.1 billion in total funding raised across the 100 recognized companies, with AI and public safety emerging as dominant investment themes. Urban SDK’s round positions the company within this broader wave of capital flowing into platforms that promise to modernize aging municipal infrastructure through software.

Expansion Plans and Competitive Landscape

Urban SDK intends to deploy the new capital toward expanding its platform capabilities and reaching additional cities, government agencies, and public-sector markets. The company’s near-term focus appears directed at deepening penetration within existing customer segments while pursuing new verticals beyond traffic management, including broader infrastructure and administrative operations.

The company operates in an increasingly active competitive field. Firms such as Zencity, INRIX, CARTO, and Via Transportation all target overlapping segments of the municipal technology market, though each with distinct product positioning. Urban SDK differentiates primarily through its focus on consolidating geospatial data workflows into a single actionable platform purpose-built for local government decision-makers.