Octopus Energy Generation, the renewables investment arm of the UK-headquartered Octopus Energy Group, has committed €40 million in Series A funding to Berlin-based smart metering point operator metiundo, marking one of the largest cleantech investment rounds in Germany so far this year.

The capital injection, announced on 10 February 2026, is expected to accelerate metiundo’s deployment of intelligent metering systems across the German building sector and fund further development of its proprietary software platform, which processes cross-sector consumption data spanning electricity, gas, heating, and water.

Scaling Installation Capacity and Software Development

Founded in 2021 by Dennis Nasrun and Felix Mücke, metiundo operates as a competitive metering point operator, a category of independent service provider that installs, manages, and extracts value from smart metering infrastructure outside the remit of the default local network operator.

The company currently has more than 21,000 smart meters deployed and employs a workforce of approximately 70 people. It plans to use the new funding to expand its installation and assembly teams, recruit specialists in software development and operations, and build integrated smart meter networks spanning multiple properties and portfolios.

metiundo’s pitch to property owners and energy suppliers centres on what it describes as an end-to-end “energy metering as a service” model. The company handles the full value chain in-house, from planning and installation through to operation, market communication, and the software integration of measurement data across energy and water utilities.

Why Buildings Are the Next Frontier for Smart Metering

Germany’s building and heating sector accounts for roughly 30% of the country’s energy-related carbon emissions, yet the penetration of smart metering remains strikingly low. According to Bundesnetzagentur data published for Q1 2025, the mandatory installation rate for intelligent metering systems stood at just 15.1%, with around 700,000 devices installed by default metering point operators. Smart meters represented only about 3% of Germany’s approximately 53 million total electricity metering points as of mid-2025.

The country’s legally mandated rollout, which was relaunched in earnest following the 2023 Act to Restart the Digitisation of the Energy Transition (GNDEW), requires 20% of mandatory installation cases to be equipped by the end of 2025, rising to 95% by 2030 for consumers below 100,000 kWh annually, and full compliance by 2032 for larger consumers and generators. Industry analysis from the Forschungsstelle für Energiewirtschaft (FfE) suggests a significant number of default operators are on track to miss the 2025 target, raising questions about whether additional regulatory intervention or enforcement may be needed.

Competitive metering point operators like metiundo, Solandeo, and Hausheld have emerged as a supplementary mechanism to speed up deployment. FfE data shows that voluntary installations, driven largely by competitive operators and customer demand, outpaced mandatory installations by a factor of 4.5 in Q1 2025 alone, underscoring the role these independent players are assuming in the broader rollout effort.

metiundo’s Multi-Utility Data Approach Sets It Apart

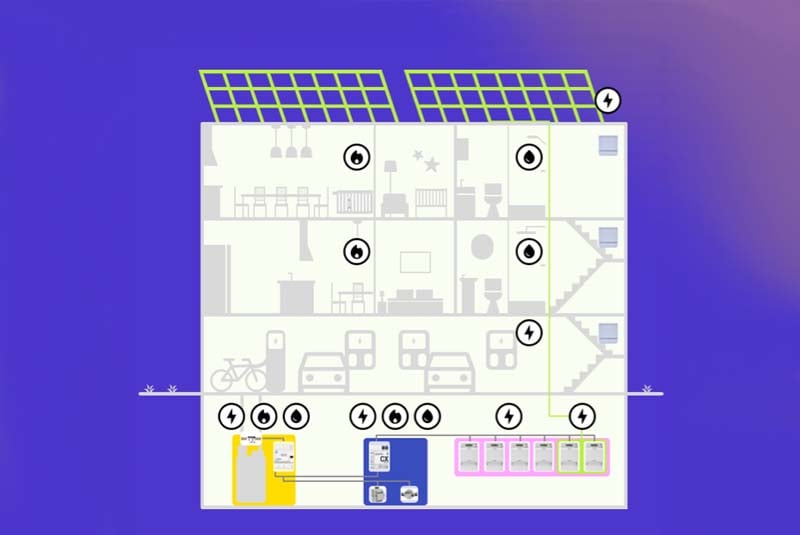

Where metiundo differentiates itself from competitors is in its integrated approach to multi-utility data. Rather than treating electricity, gas, heat, and water as separate measurement silos, the company’s platform maps consumption data directly onto building structures, creating what it describes as a holistic picture of a property’s energy and water profile.

This is designed to enable downstream applications such as optimisation of on-site solar generation and battery storage, tenant electricity models, heat pump management under Section 14a of the German Energy Industry Act, and compliance with emerging ESG reporting requirements. The company says its platform architecture was built from scratch in-house, allowing for faster iteration and more flexibility than legacy utility systems.

Octopus Energy’s Deepening Footprint in Germany

The metiundo investment extends Octopus Energy’s already substantial commitment to the German energy market. Since launching in the country in 2020 through the acquisition of Munich-based startup 4hundred, Octopus has grown rapidly to surpass one million German retail customers by late 2025, the first market outside the UK to reach that milestone.

On the generation side, Octopus Energy Generation has been pursuing a stated goal of investing €1 billion in German solar and wind assets by 2027. The company has completed at least ten investments in German renewables in under three years, including the acquisition of Hamburg-based MN projects GmbH in May 2025, which added a 2 GW pipeline of solar and battery storage projects. More recently, in late 2025, Octopus launched a joint venture with Energiequelle to serve commercial and industrial energy customers across Germany, Austria, Poland, and the Czech Republic, backed by a €200 million investment commitment.

The metiundo deal represents a strategic expansion beyond generation and retail supply into the digital infrastructure layer that underpins building-level energy management, a move that aligns with broader industry trends linking smart metering data with distributed energy resource optimisation.

A Competitive and Regulatory Landscape in Flux

Germany’s smart metering market is attracting growing investor attention as the gap between rollout ambitions and actual deployment becomes more apparent. In late 2024, UK-based infrastructure fund Ancala acquired both Solandeo and a 50% stake in Hausheld to build a metering portfolio in Germany. In October 2025, private equity firm Aurelius agreed to acquire the EMEA metering business of Landis+Gyr for $215 million and the international water and heat metering unit of Xylem in back-to-back transactions.

Meanwhile, Berlin-based Ostrom raised €20 million in recent months to accelerate its own smart meter adoption and virtual power plant capabilities, providing a directly comparable domestic fundraise to metiundo’s.

Industry observers expect the Federal Ministry for Economic Affairs and Energy to issue a statement clarifying the future organisation of the smart meter rollout, particularly regarding enforcement of targets and the potential bundling or outsourcing of obligations by smaller default operators that are struggling to meet their quotas.