Ouster has completed its $35 million acquisition of StereoLabs SAS, combining its digital lidar hardware with stereo camera technology and AI-driven perception software. While the deal targets a broad range of applications from robotics to industrial automation, its implications for smart city infrastructure, particularly intelligent traffic management, public space security, and urban crowd analytics, could be among the most significant for municipalities currently investing in sensor-driven decision-making.

The transaction, which closed on February 4, 2026, was structured as approximately $35 million in cash plus 1.8 million Ouster shares, with 0.7 million of those shares vesting over a four-year period. StereoLabs will operate as a wholly owned subsidiary.

Why This Matters For Smart Infrastructure

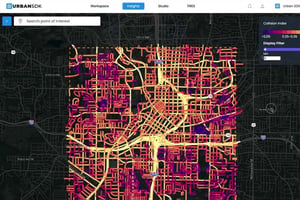

Ouster is not a newcomer to the municipal technology space. The company already operates one of the more established lidar-powered smart infrastructure portfolios in the market, built around two core software products: Ouster Gemini, a 3D digital lidar perception platform for security, crowd analytics, and spatial intelligence, and Ouster BlueCity, a turnkey traffic management solution designed to replace legacy inductive loops and camera-based detection systems at signalized intersections.

By the end of 2024, Ouster had expanded software-attached deployments to more than 700 sites globally, with software bookings growing over 60% year-over-year. Gemini alone was adopted at over 300 locations, including deployments with a major commercial real estate company for retail foot traffic monitoring. BlueCity, meanwhile, was projected to expand to over 400 sites, including a $2 million contract to grow the lidar-powered smart traffic network in Chattanooga, Tennessee, described as the largest such network in the United States. A pilot in Chattanooga achieved a reported 100% reduction in near-miss incidents on a high-risk city block.

The StereoLabs acquisition now layers stereo camera capabilities and AI vision software on top of this existing infrastructure platform, potentially enabling richer data collection at intersections, public spaces, and critical facilities where lidar is already deployed.

What Stereo Cameras Add To Urban Sensing

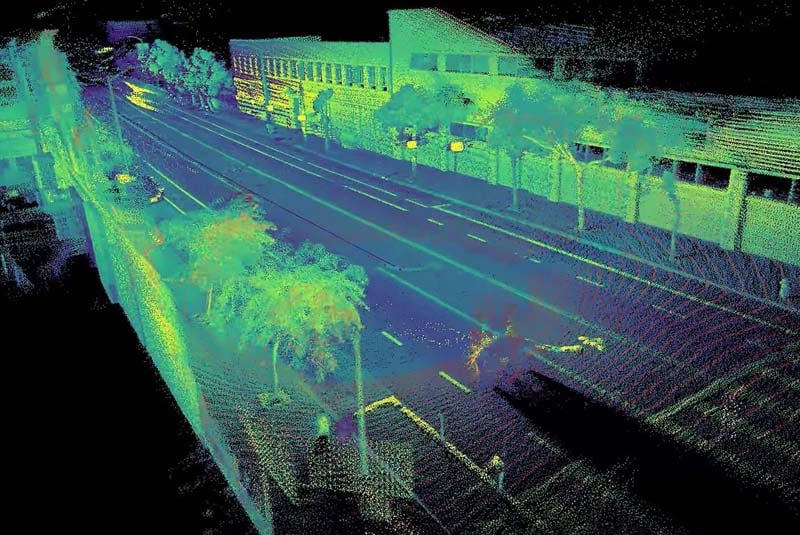

Current lidar-based smart city systems excel at precise 3D spatial mapping, object detection, and tracking across all lighting conditions, day, night, fog, and rain. However, lidar alone cannot capture color, texture, or fine visual detail. This is where stereo cameras fill a gap.

StereoLabs’ ZED camera line delivers high-resolution 2D and 3D color data with low latency, and the company has developed a proprietary Neural Depth Engine, a foundational AI model trained on approximately 10 million images that can determine object depth from stereo camera data. The cameras run on embedded NVIDIA Jetson Orin compute modules, enabling real-time AI processing at the edge rather than relying on centralized cloud infrastructure.

For smart city applications, the addition of synchronized camera data alongside lidar could enhance several critical capabilities. In traffic management, it could enable license plate recognition, vehicle type classification by visual detail, and detection of visual indicators such as turn signals or brake lights, all information that lidar cannot capture on its own. For public space security, fused lidar-camera systems could provide perimeter monitoring with both volumetric 3D detection and visual context, reducing false alarm rates while offering richer incident documentation. In crowd analytics, stereo vision adds density estimation and behavioral pattern recognition that goes beyond the 3D point-cloud tracking lidar provides.

Ouster had already taken a step toward multi-sensor integration before this acquisition by completing a partnership with Genetec Security Center, a widely used video management platform, allowing customers to fuse lidar and video surveillance into a single operational interface. Owning the camera hardware and perception software in-house, rather than relying on third-party camera providers, could accelerate how tightly these data streams are integrated going forward.

A Consolidation Wave Hits The Perception Sensor Industry

The StereoLabs deal is part of an accelerating wave of mergers and acquisitions reshaping the perception sensor market. Just weeks before this transaction closed, MicroVision acquired lidar assets from bankrupt Luminar Technologies for $33 million through a U.S. Bankruptcy Court auction. Ouster itself merged with Velodyne in February 2023, creating one of the largest lidar companies globally with more than 850 customers and a combined patent portfolio exceeding 670 granted and pending filings at the time.

This consolidation is driven by a market reality that MicroVision CEO Glen DeVos put plainly: the sensor industry does not yet generate enough revenue to sustain all its current competitors. For municipalities and smart city integrators, this trend could carry both benefits and risks, fewer vendors may mean more capable and financially stable suppliers, but it also raises concerns around vendor lock-in, long-term pricing power, and interoperability with open infrastructure platforms.

Financial Details And Integration Timeline

On the financial side, StereoLabs reported unaudited revenue of approximately $16 million in fiscal year 2025 and was EBITDA-positive. Ouster’s CFO characterized it as a high-growth, high-margin business during a February 9 conference call.

Ouster will begin consolidating StereoLabs’ financial results in Q1 of fiscal 2026, covering roughly seven weeks of combined operations. The company’s Q4 fiscal 2025 earnings, scheduled for March 2, 2026, will not yet reflect any StereoLabs contribution. Ouster, which trades on Nasdaq under the ticker OUST, has shipped nearly 150,000 lidar sensors to more than 1,000 customers worldwide and reported Q3 2025 revenue of $39.5 million, up 41% year-over-year.

StereoLabs’ co-founders Cecile Schmollgruber, Edwin Azzam, and Olivier Braun will remain in leadership positions, and the company has shipped more than 90,000 ZED cameras to over 10,000 customers across robotics, industrial, and smart infrastructure applications.

What Cities And Integrators Should Watch

For transportation departments, municipal planners, and smart city integrators evaluating perception sensor investments, several questions remain open. It is not yet clear how quickly Ouster will integrate StereoLabs’ camera technology into its existing Gemini and BlueCity platforms, or whether fused lidar-camera packages will be offered as turnkey products for infrastructure applications. The company has emphasized continuity for existing product lines but has not yet detailed a specific roadmap for combined smart infrastructure offerings.

The broader market context suggests these capabilities are headed in this direction. The global lidar market was valued at approximately $2.9 billion in 2025 and is projected to reach $3.5 billion in 2026, according to Precedence Research, growing at roughly 20% annually. Ouster itself has identified a $19 billion addressable market opportunity in smart infrastructure alone.

Whether the StereoLabs acquisition translates into tangible improvements for municipal customers will depend on how effectively Ouster merges two distinct technology stacks, developer ecosystems, and product roadmaps into integrated solutions that are simple to deploy, maintain, and scale at the intersection, corridor, and city-wide level.